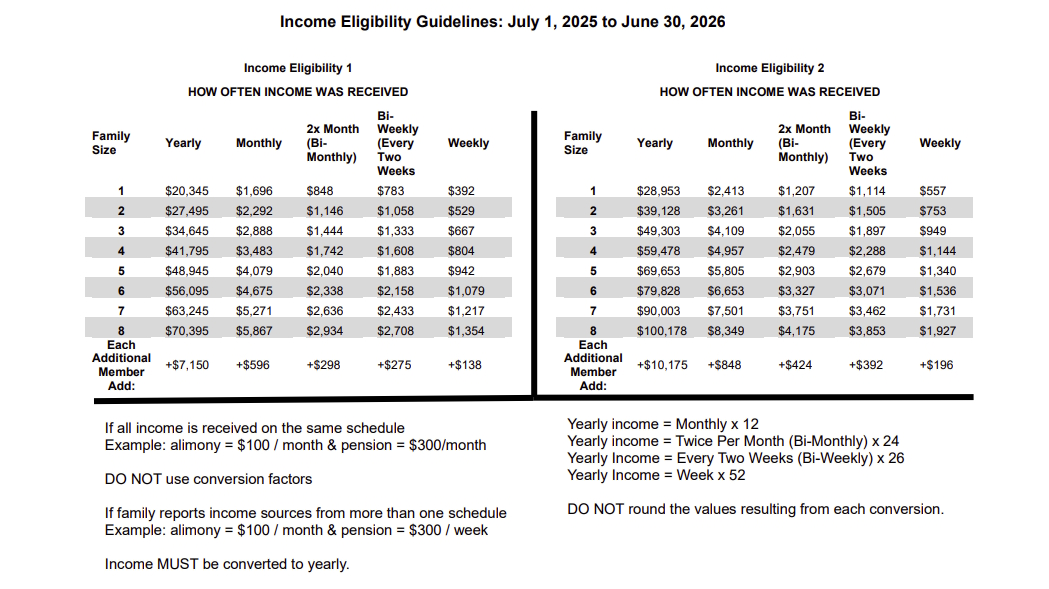

The Arizona Department of Education provides the following Fiscal Year 2026 Income Guidelines for determining income eligibility for a various state and federal programs. This form should be utilized by households with students that attend schools that do not offer the National School Lunch Program (NSLP) or by households with students that attend schools operating a special provision option in a non-base year for the NSLP. Organizations should retain completed forms for a period of five years.

Definition of Income: all items such as wages and salaries before any deductions, and other income, such as self-employment, welfare, social security, retirement benefits, unemployment compensation, worker’s compensation, aid for dependent children, alimony, child support, pensions, insurance, or annuity payments, etc.

Exclusion: the value of meals, milk, or EBT benefits to children shall NOT be considered income in the household.

If your household qualifies, please complete the following information for each student.